Key data on the property market in Bremen

A stable market with excellent prospects

The situation on the Bremen real estate market presents a mixed picture. The opportunities for logistics properties, investment properties or the redevelopment of neighborhoods remain very good.

You will find these and other figures in the annual real estate report, which Bremeninvest produces for the Bremen property market in collaboration with renowned market analysis institutes.

On this page, you will find the latest data for the investment market and the office, logistics, residential and retail real estate segments.

You can download the reports from the past two years in the right-hand navigation panel. All of the reports are also available on the Downloads/Publications page.

You can receive regular updates on the latest developments by reading our Bremen-Stories.

2023: Take-up | Construction Activity | Price Levels

- Vacancy rate only slightly increased at 3.7% (2022: 3.3%)

- Leased office space 2022: crisis-proof at 95,000 m² (2020 and 2021 record years)

- Leased office space 2023: First half of 2023 off to a good start (46,000 m²)

- 62,000 m² of new office space completed in 2022 (forecast 2023: over 91,000 m² of new office space)

- Prime rents around 14.30 euros/m²

(Please click to view the pictures)

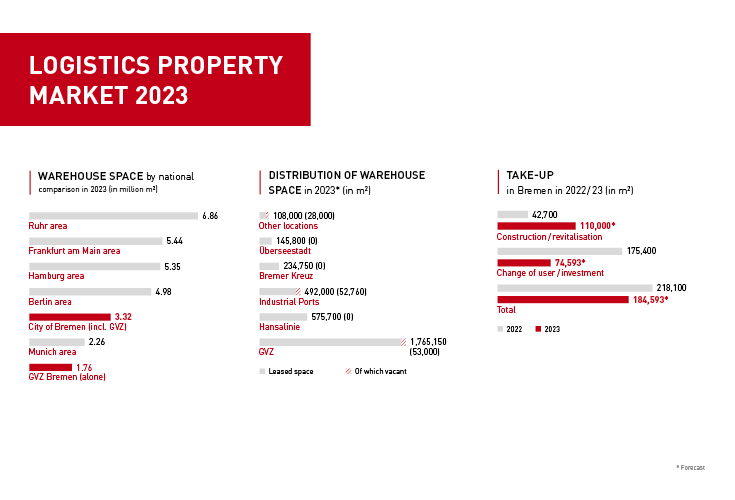

2023: Take-up | Commercial estates | Price Levels

- Logistics warehouse space inventory up slightly to 3.238 million m² (2022: 3.2 million m²)

- Take-up: 184,593 m² (2022: 218,100 m²)

- Vacancy rate low at 4.03% (2022: 1.54%)

- 133,760 m² of free warehouse space available

- Rents for logistics properties between 3 and 7 euros/m² (previous year: 3.38 euros/m²)

- GVZ Bremen: Logistics buildings with a total area of 1.76 million m²

2023: Structure | Locations | Price levels

- City center is undergoing structural change

- The faculty of law at the University of Bremen is moving to the city centre into 18,000 m²

- Purchasing power increased to 4,076 million euros (Report 2022: 3,988.2 million euros)

- Sales at 3,944.6 million euros (Report 2022: 3,731.6 million euros)

- Retail rents: City center peaks at 112 euros/m²

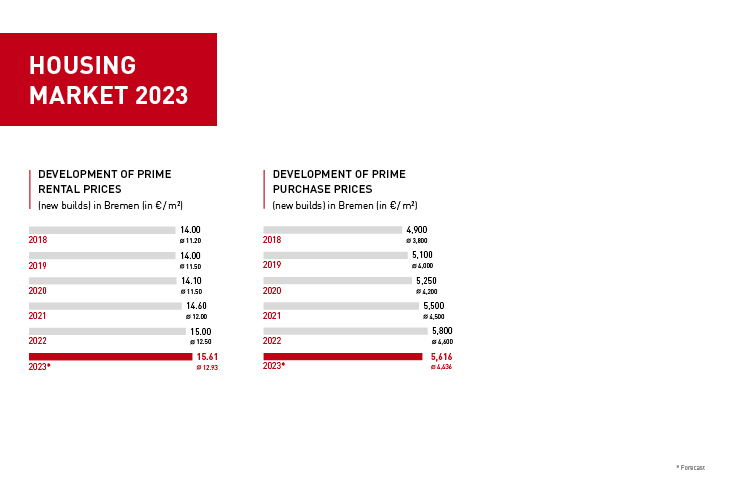

2023: Demographics | Price levels | Forecasts

- Around 1,000 housing units are being built in the Hulsberg district, the first of which are to be ready for occupancy in 2023

- Purchase prices under pressure, rents on the rise

- Around 10,000 new residential units to be built in Bremen by the end of 2025

- Average rent level for new apartments 12.50 euros/m² (increase of 4.2 %)

- Average purchase prices at 4,600 euros/m²(2022: 4,500 euros/m²)

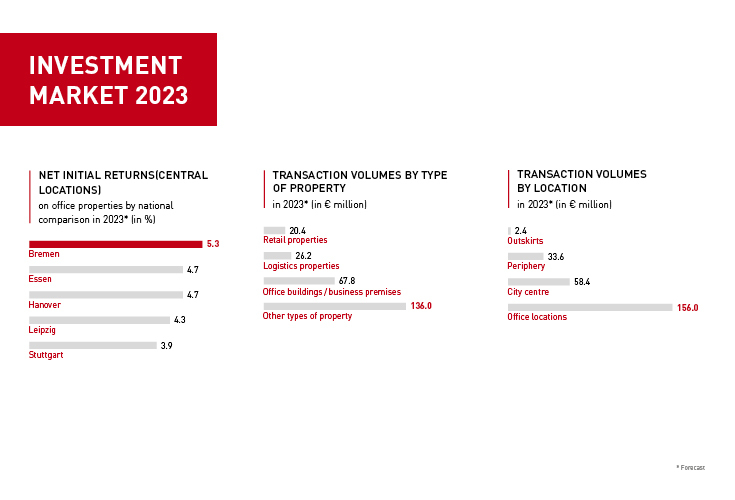

2023: Transactions | Yields | Price levels

- Investment volume in the first half of the year of 125.2 million euros

- Transactions smaller: half had a volume of less than five million euros in 2022

- In terms of property types, demand was particularly strong for the office asset class, with a volume of around 137 million euros and a market share of around 44 percent